The Real Estate & Air Quality Series: Part 1

Air pollution is usually talked about as a public health or environmental issue, but recent research shows that it also has clear economic effects, especially in real estate. We have identified five pollutants and made them available to investors, who can link them to their assets and locations to monitor this risk.

Pollutants such as ozone and sulphur dioxide influence property values, tenant demand, and the daily experience of people inside the building. Because of this, air quality is becoming an important factor for real estate investors and companies that rent office space.

Five Main Pollutants

According to the European Air Quality Index (AQI), the most important pollutants are:

- PM2.5 which consists of very fine particles (smaller than 2.5 micrometers) that can enter the bloodstream and are linked to serious health risks.

- PM10 which consists of slightly larger particles that irritate the airways.

- Ozone (O3) which is harmful at ground level and forms on sunny days.

- Nitrogen dioxide (NO2) which mainly comes from traffic and industrial combustion and can cause respiratory irritation, reduced lung function and a higher risk of infections.

- Sulphur dioxide (SO2) which is released when fossil fuels are burned, impacts humans by irritating the respiratory system and triggering coughing or shortness of breath.

To illustrate how air quality exposure has developed across major European office markets, the figure below compares long-term PM2.5 concentrations in selected cities. PM2.5 is widely regarded as the most harmful air pollutant due to its ability to penetrate deep into the lungs and bloodstream, making it a key indicator for health-related risk in real estate. Paris and Amsterdam show encouraging decreases, and Stockholm never really had a problem.

Figure 1: Long-term trends in fine particulate matter exposure across major European cities, benchmarked to WHO standards.

Why This Matters for Investors

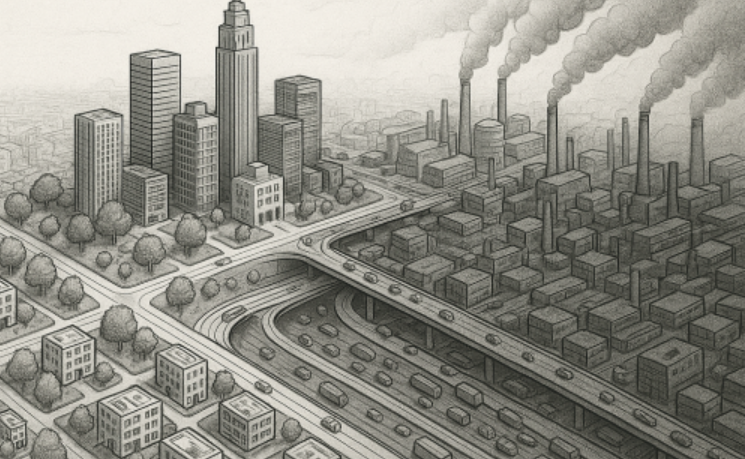

For investors, air quality has become part of what defines the attractiveness of a location. Properties in areas with high pollution levels, such as near busy roads or industrial zones, often face lower demand and slower appreciation. Tenants, especially companies with a focus on sustainability and employee well-being, increasingly pay attention to environmental factors.

Buildings in cleaner areas often achieve higher rents and experience better tenant retention. As regulations around emissions and air pollution become stricter, locations with cleaner air may gain further advantages, while polluted areas could face higher upgrade or compliance costs.

How Air Pollution Affects Employees Inside Buildings

Pollutants from outside, such as PM2.5 and NO2, can enter buildings through ventilation systems or open windows, and once inside they influence indoor air quality and affect how people feel and perform. Research shows that higher levels of PM2.5 can reduce cognitive performance, making it harder for employees to concentrate or solve problems.

NO2 is linked to more respiratory infections, which means more sick days, while ground-level ozone can cause breathing difficulties, especially during warmer months. As a result, companies may experience lower productivity, higher absence, and reduced satisfaction among employees (Ebenstein et al., 2016). For real estate investors, this makes buildings with poor indoor air quality less attractive to tenants, particularly in competitive office markets.

Air quality is important for all buildings, but certain sectors are even more sensitive. Hospitals and healthcare facilities rely on very clean air to protect vulnerable patients, elementary schools host children whose lungs are still developing, and elderly care homes accommodate older adults who are more prone to respiratory issues. In these sectors, poor air quality can lead to safety concerns, regulatory challenges and reputational damage, which significantly influences the value and desirability of these properties.

What Academic Research Shows About Air Pollution and Real Estate Prices

A growing number of studies show a clear connection between air quality and real estate value. For example, a large study in Beijing found that a 1% increase in PM2.5 causes an approximately 0.541% decrease in house prices (Zheng et al., 2019). Another study using a panel set of 280 Chinese cities over 2003-2018 found that long-term clean-air policies increased housing values by around 4.4 percent (Lin & Zheng, 2023).

Chinese residential markets differ enormously from European markets. However, European research shows similar results. When low-emission zones (LEZ) were introduced in German cities, local air quality improved by lowering PM10 and NO2 levels. These improvements also showed up in the housing market. Apartments inside LEZ areas became about 1.7 to 2 percent more expensive to rent, which means that people are willing to pay extra to live in cleaner neighborhoods. The study also shows that apartments in these zones rented out faster, suggesting higher demand. Overall, the results make it clear that even relatively small improvements in air quality can positively influence real estate values (Baldauf & Peter, 2020).

Lastly, even temporary pollution events have an impact. After a major gas leak in Los Angeles caused a short-term drop in air quality, single-family houses within a 5 mile radius sold for 8.6 percent less on average. The decrease in price did not recover for 18 months, which could indicate that buyers take air quality seriously (Currie et al., 2023).

Conclusion

Air pollution clearly affects property values, rental demand and the well-being of employees inside buildings. Research consistently shows that cleaner air leads to higher real estate values, while polluted areas experience lower demand and financial penalties.

For real estate investors, air quality should be part of due diligence, ESG analysis and long-term risk planning. As awareness and regulations continue to grow, properties with good air quality will increasingly stand out and perform better over time.

In our next blog, we dive into the data behind air quality and show how understanding these patterns can support better real estate decisions.

References

- Zheng, S., Wang, R., & Kahn, M. E. (2019). Economic effects of air quality on housing prices: Evidence from Beijing, China. Utrecht University.

https://research-portal.uu.nl/en/publications/economic-effects-of-air-quality-on-housing-prices-evidence-from-b - Lin, Z., & Zheng, S. (2023). The value of clean air: Evidence from China (MIT Center for Real Estate Working Paper).

https://cre.mit.edu/wp-content/uploads/2023/06/The-Value-of-Clean-Air-2023-6-11-zhenguo-lin.pdf - Baldauf, M., & Peter, F. (2020). Air pollution and the housing market: Evidence from Germany’s low emission zones. Vrije Universiteit Amsterdam.

https://research.vu.nl/en/publications/air-pollution-and-the-housing-market-evidence-from-germanys-low-e - Currie, J., Davis, L. W., Greenstone, M., & Walker, R. (2023). The effect of environmental disasters on housing prices: Evidence from the Aliso Canyon gas leak. Journal of Environmental Economics and Management.

https://www.sciencedirect.com/science/article/abs/pii/S1051137723000530 - Ebenstein, A., Lavy, V., & Roth, S. (2016). The long-run economic consequences of high-stakes examinations: Evidence from air pollution. American Economic Journal: Applied Economics, 8(4), 36–65. https://doi.org/10.1257/app.20150084